That time, effort, and often agony isn’t misplaced:

“When you name something, it anchors it in people’s minds. The name and the thing are then forever connected. It creates brand recognition.”

– Brandwatch

Sometimes, people are lucky; sometimes, a name is sitting there, ready to be taken, and sometimes, people have names before they even have a product. But for most of us, branding often costs… and it can cost a lot—whether it be time, mental space, or the money it costs to get an agency involved (Exxon spent $100 million on its brand name).

We’ve recently been through the process of naming our own product and helping other products through the process, too. In this post, we’ll share what we’ve learned and the steps that have worked for us.

As it turns out, the process is not all that dissimilar to panning for gold…

The (Gold Panning) Naming Process:

- Step 1. Pick your territory

- Step 2. Fill the pan

- Step 3. Stir the pan

- Step 4. Sift the pan

- Step 5. Score the nuggets

- Step 6. Pick your winner

The Iterative Research Process

This article includes many references to Positly for participant recruitment, Google Sheets for analyzing results, and GuidedTrack for building activities. These services are all easy to use and incredibly useful, so if you haven’t signed up for them yet, I recommend you do so now so you can follow along and look at the examples and templates.

Throughout the course of this article, you’ll follow the iterative research process of designing your research, building your studies (we recommend using Guided Track), delivering the study to participants (we recommend you use Positly), and analyzing results (we recommend Google Sheets for this study).

Each time you go through the cycle, you’ll narrow in on the right answer to your research question – in the case of this article, it’s what name is right for you!

Step 1. Pick your territory

When you’re panning for gold or picking names, you need to have a good lay of the land, and you need to know what you’re looking for.

The first step in the process is deciding on what attributes you care about and what territory you’ll explore.

Every brand has different needs when it comes to the name. Also, founders and staff generally have different preferences. Before getting started I encourage you to articulate the attributes you want in the name.

These attributes could be very specific, such as “it must include the word ‘blockchain’ so we can get 10x investment!” or they could be more general, such as “needs to be available as .com”.

You will use these later to limit the search space and to score each name.

Here are the attributes we chose when we were searching for our name:

Available (or inexpensive) as .com (and most social media)

- Trademarkable (not too descriptive, not taken already in the industry)

- Distinct (not similar to other brands)

- Meaningful (have at least some relevant meaning)

- Memorable (not easily substituted for analogous abstract concepts, e.g., General Motors could be mistaken for Common Engines)

- Scalable (allow us to expand into different product lines, markets, or geographies)

- Short (easy to brand, easy type, few syllables, easy to fit on materials)

- Positive affect (reminds people of nice things, not bad things)

- Good for SEO (doesn’t use competitive terms, no negative history)

- Easy to pronounce (not easily mistaken)

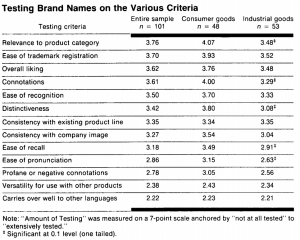

In Chiranjeev Kohli‘s 1997 paper on brand considerations, he outlined the criteria on which industry professionals typically test for in brand names:

There are many affective attributes that are important, such as how much they like the name, enjoy saying it, find it memorable or distinct. There are many things written on name attributes but the two resources I recommend are the Chiranjeev Kohli study in the above table and the Golden Rules from Brandwatch.

Here are some of the affective attributes we commonly recommend scoring on:

- likable

- positive

- easy to remember

- easy to say

- meaningful

- distinct or unique

- free from negative connotations

- relevant to the product category

- relevant to the product description

The Territory

Once you know what you’re looking for, you’ll need to know where to find it!

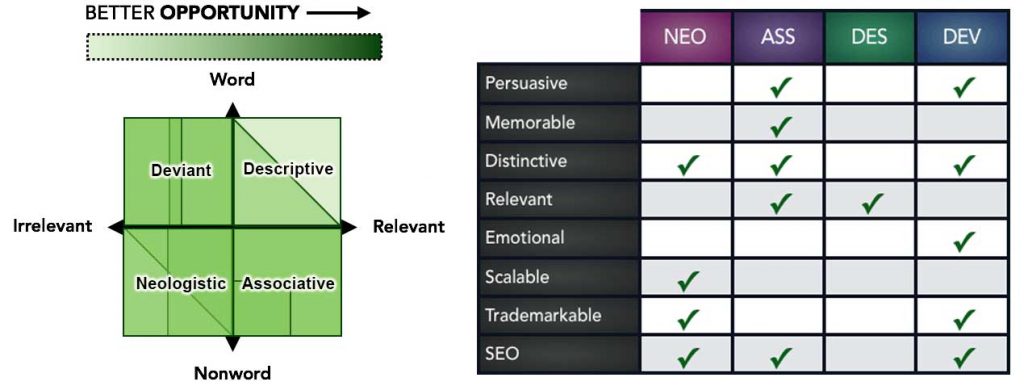

For exploring the territory I recommend Nick Kolenda’s framework* of name types.

According to his framework, names typically fall into one of the following categories:

- Descriptive (relevant words)

- e.g. General Motors, Electronic Arts, Sydney Theatre Company

- Associative (relevant non-words)

- e.g. Facebook, YouTube, Microsoft

- Deviant (irrelevant words)

- e.g. Apple, Amazon, Pandora

- Neologistic (irrelevant non-words)

- e.g. Exxon, Spotify, Kodak

Like many companies, we initially started off with descriptive names; in fact, we went through two descriptive names (“Participant Recruiter” and “Task Recruiter”) while the product was an internal tool and was in an early beta.

We found that these are (a) probably the most problematic names (unavailable, hard to trademark, surprisingly hard to remember) and (b) the names people suggested and instinctively preferred more often (when you’re an unknown quantity).

Our early names had already caused us trouble, so we finally bit the bullet to try again; we naturally started by looking into descriptive names again. After finding that so many of them were already taken or very unsuitable, we discovered this article, and from that point on, we were fairly sure that if we kept going down that avenue, they wouldn’t tick enough boxes for us, especially after this suggestion:

“In the end, any type of name can work. One type isn’t better than another. You simply need to weigh the importance of each factor. However, I do have one universal suggestion. You should always avoid the extreme top-right of the scatterplot [very descriptive words].”

After realizing that descriptive names were probably out of the question, we started exploring other options.

We moved onto neologistic names (like Exxon) for a while and discovered that they can be difficult to come up with. They would take a lot of effort to get into people’s memory, and so many of the short and pronounceable ones were already taken. The internet ran out of four-letter .com domains in 2013, and most pronounceable five-letter ones are already gone, too!

Then, we looked at deviant names (like Apple). These are great because they are words that people are already familiar with, and they may often be trademarkable within your industry. However, after we searched roughly 20,000 thousand English words for dot com availability, we found that few of them are available for the type of money an early-stage business would be willing to spend.

So, that left us with associative names (like Microsoft). We decided to focus our search space on associative names because we felt they ticked the most boxes for us.

Step 2. Fill the pan

Once we knew what we were looking for, we needed to generate a bunch of relevant words related to the brand; these would become the building blocks for new names. We took a few approaches, ranging from brainstorming them ourselves to asking people on social media and running studies on our own platform (that is what we do, after all!).

We built a simple Guided Track program so that people could be given a description of the product and then asked to generate as many relevant nouns as they could, followed by as many benefits as they could. We also asked them to include associative words such as “cheetah” or “falcon” for “fast,” as these can also be helpful later when naming.

Before asking participants about what words came to mind, I recommend properly describing the product; a product description page like this one can be worth including prior to the main activity.

Here are the Product Word Generation templates we have built based on the studies we’ve conducted – they’re yours to customize for your own studies, completely free:

- Template Program: demo, customize

- Example Program: preview, copy

- Analysis Spreadsheet: preview, copy

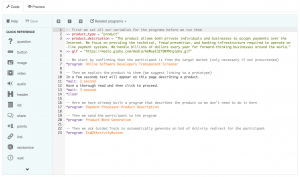

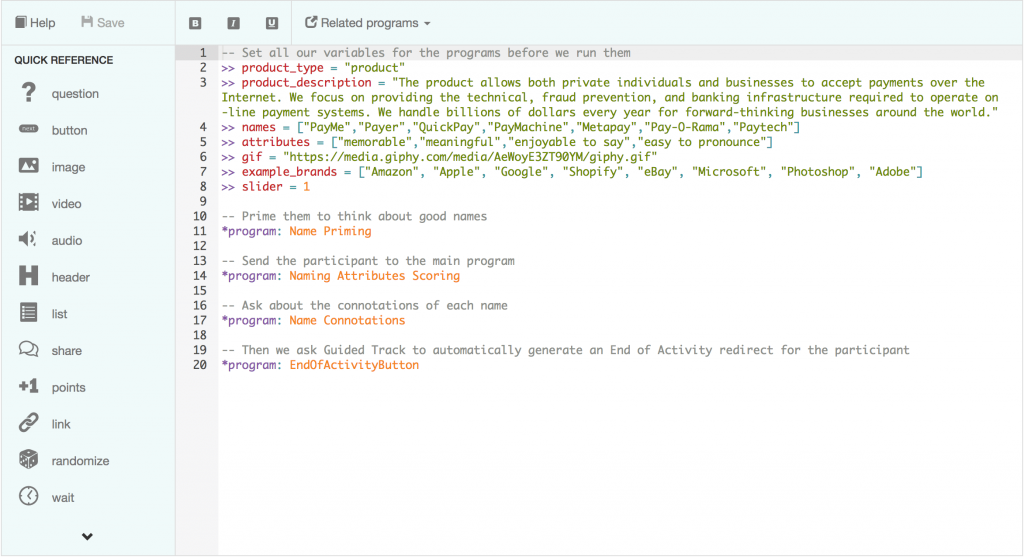

Please have a look at the code of my example program (above). You can see that all I have done to customize it is set the attributes for my product and add some extra programs that I wanted (e.g., a Transparent Screener program and the Product Description program).

It’s really that simple! It takes only a few minutes to get started. I’ve even built a customization program that you can use to get started.

Once you’ve customized the program, you can start getting data from participants by firing up Positly, creating a new run, and pasting a link to the program as your activity link. You’ll have data coming in within minutes.

Step 3. Stir the pan

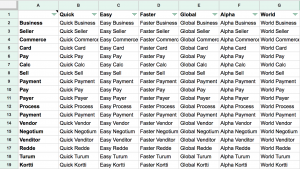

Once you have your base words, you can try mixing them up to create potential names.

In the case of associative names, this is done by blending them, adding prefixes, adding suffixes, removing letters, replacing letters, creating homophones, translating them to other languages, and any relevant technique.

Check out this example from Nick Kolenda’s blog (the example is a calculator):

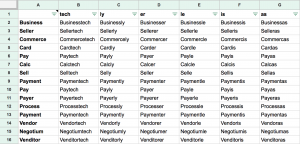

We have built some Google Sheet tools for you so that you can plug in your own words and start generating brand names!

- Word Matrix Matrices (for prefix, suffix and blends)

- Word Translations (for trying other languages)

I also recommend using these two websites to merge and combine words:

After this step it is quite likely you’ll have thousands (if you want that many!) of names and a reasonable percentage of these may be little nuggets of gold. The next step will be to sift the pan for those nuggets.

Step 4. Sift the pan

Now that your pan is full of dirt with hidden nuggets, you’ll need to sift through it to find them. Once you’ve sifted them out, you can put them to the test.

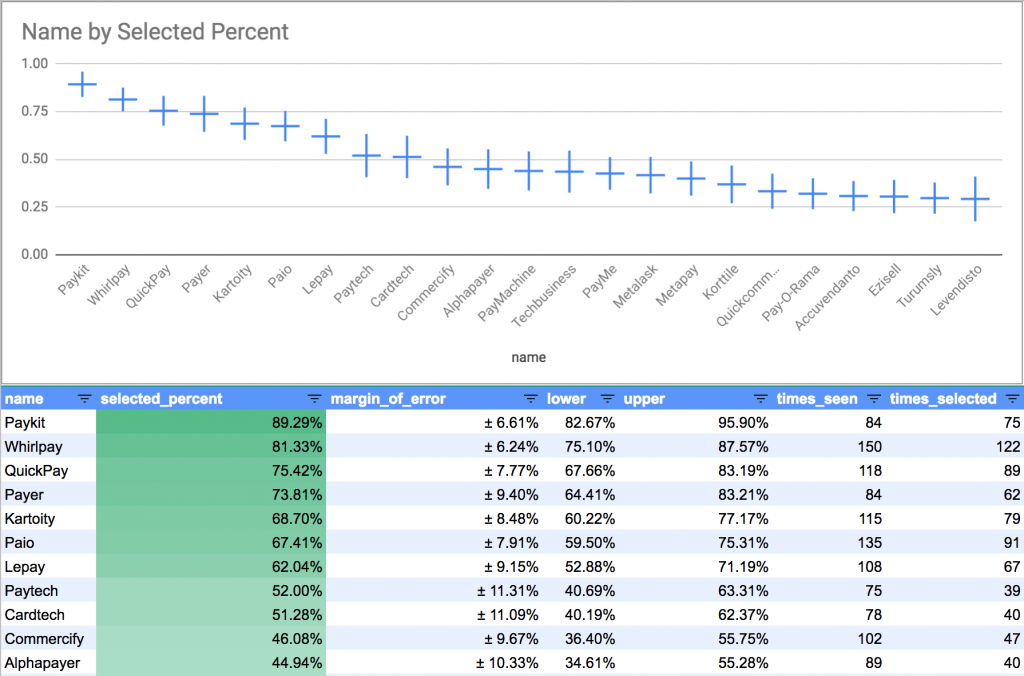

I recommend scrolling through them all quickly, marking any that grab your eye, and putting them all into a list. Try to pick only ones with decent potential, as the next step will work best with fewer than 200 names, ideally less than 50 (there’s really no limit to how many names you could start with—it’d just take a lot of rounds of naming with participants).

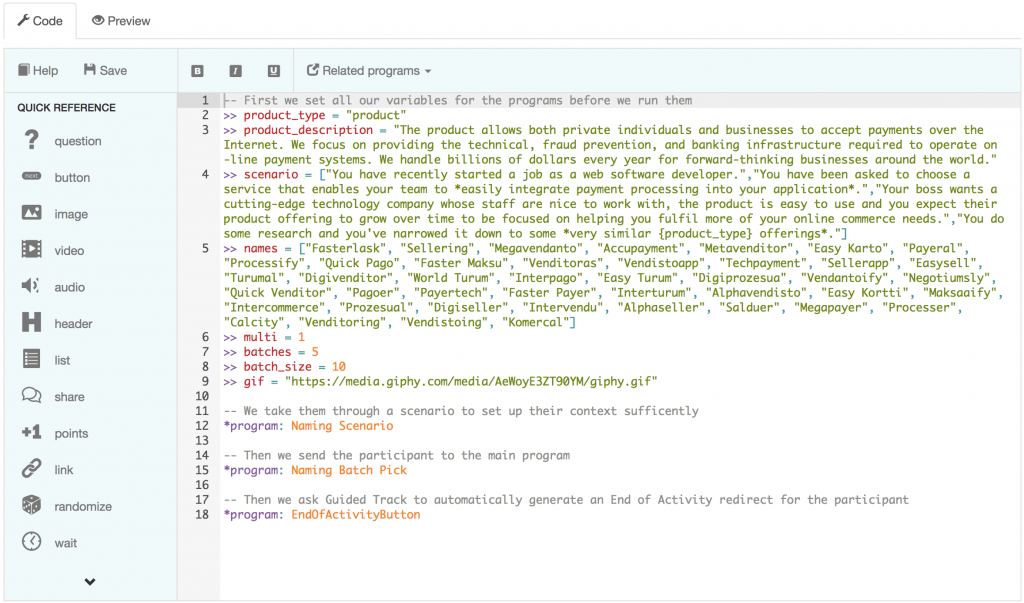

Once you have your big list, I recommend doing a Batch Pick study (see templates below) in which the names are broken into batches, and the participants can pick their favorite from each batch. If you have a very large list, you may want to have larger batches and enable a checkbox instead of a single select (simply set the parameter multi to anything).

Before going straight in and asking users about names, you may want to prime them to think about good names and perhaps set up a scenario first.

You can use these Naming Batch Pick templates to build your own studies and analysis:

- Template Program: demo, customize

- Example Program: preview, copy

- Analysis Spreadsheet: preview, copy

As you can see in the example program, all I have done to customize it is to set the attributes for my product and add in some extra programs that I wanted (e.g., the Naming Scenario program).

If you need help customizing your program, try the customization program, or feel free to get in touch.

Step 5. Score the nuggets

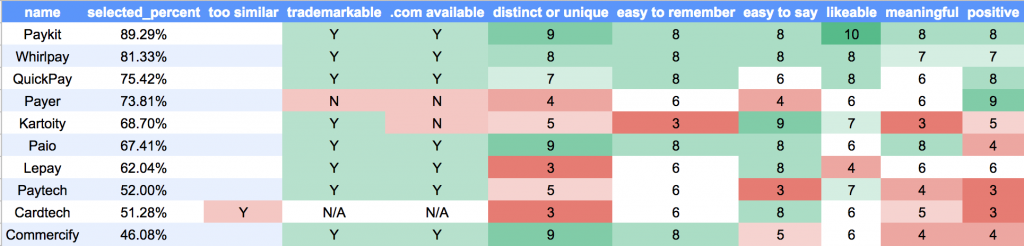

At this stage, I’d recommend using our scorecard template (preview, copy) and taking the following steps:

- Remove names that are too similar (lest they split the vote)

- Check the domain name availability (.com and other relevant ones)

- Check the trademark availability (in your industry and in general)

- Give every name a score of your own on each attribute

These steps should help narrow it down to your top 5 or so names.

You’re on the home stretch. You have a few names that seem reasonably good, but you really need to look at how they make people feel and how well they perform on the attributes that are important to you.

We normally use a Likert Scale to test how strongly a participant agrees or disagrees with the statement in the format “brand is attribute” ( e.g., “General Motors is easy to remember”).

For this part of the process, each name will be scored based on each attribute. Because the total number of attributes will be asked for each brand name, the number of questions will grow significantly if you have more brands or attributes. Therefore, at this point in the process, you want to have at most 5-6 names and 5-6 attributes to prevent the number of questions from blowing out.

You can use these Naming Attributes Scoring templates to build your own studies and analysis:

To customize the program, all that’s needed is to set the attributes for my product, as you can see in the example program.

In this example, I also opted to add in some extra programs that I wanted, such as a Name Priming program and another one that asked about the Name Connotations.

If you want help customizing your program, try the customization program or feel free to get in touch.

Step 6. Pick your winner

By now you may have a clear winner… if you do, then this GIF is in order:

Unfortunately, in many cases, you’ll be stuck with a near tie between 2 or 3.

To break the tie, you’ll need to be clear about where the ambiguity is coming from. I suggest sitting down with your team and talking about this. You may need to apply a weighting to some of your attributes (e.g., “distinctiveness” may be twice as important as “easy to say”) or run some of the studies again with fewer names (the higher-performing ones).

For us, we had a very close tie that was only finally broken by doing a straight head-to-head comparison between two names with 400 participants until we reached statistical significance.

The Batch Pick naming program can easily be customized and combined with other programs to help decide on the final two or three names. In this example program, all I do is set the batches to 1 and the batch_size to 2, and “Voilà!” we have a study that we can implement to break that tie

Yay! Now what?

Congratulations! You’ve survived a difficult and often heart-wrenching process that’s full of ambiguity and covers both squishy human feelings and hard analytical approaches. At the end of this process, you should have a name that you can feel much more confident about.

The next step is to develop your brand and pricing models. Just like naming, you can be a little bit more scientific about them than simple guesswork. You can look to best practices and then run your own studies at every step of the process.

If you would like help with your naming studies, please don’t hesitate to get in touch.

If you have any questions, suggestions, feedback, or experiences to share, please join us in the comments below. Feel free to subscribe to this blog to get notified of future updates.

Want some further reading? I recommend these three articles that were referenced earlier in this post: How to Name a Product: A Step-By-Step Walkthrough, Creating effective brand names: A study of the naming process and How to Name a Product: 5 Golden Rules we Follow.